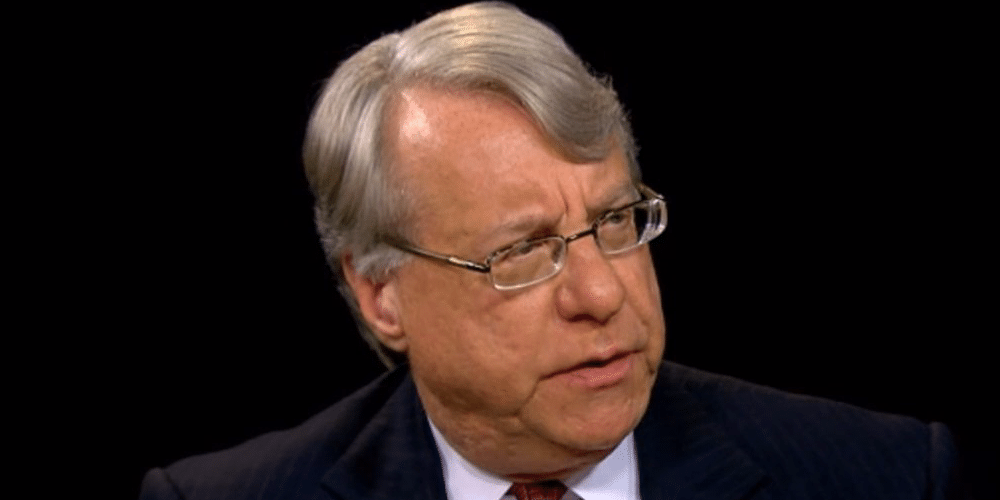

Jim Chanos, one of the most prominent figures in the world of finance, has built an impressive reputation as a short-seller and activist investor. His journey in the financial markets, particularly his knack for identifying overvalued companies, has captured the attention of investors worldwide. In this article, we will delve into the life, career, and net worth of Jim Chanos, providing a comprehensive overview of his contributions to the financial industry.

With a career spanning several decades, Chanos has earned a reputation for his ability to uncover weaknesses in companies, often predicting market downturns accurately. His expertise in short-selling has made him a household name in the financial community, and his insights continue to shape the strategies of numerous investors.

As we explore the various aspects of Jim Chanos's life and career, we will also examine the factors contributing to his net worth. This article aims to provide a detailed and well-rounded perspective on his financial journey, supported by data, statistics, and credible sources.

Read also:Comprehensive Remoteiot Vpc Review Your Ultimate Guide To Secure Networking

Table of Contents

- Biography of Jim Chanos

- Early Life and Education

- Career Highlights

- The Art of Short-Selling

- Chanos and Enron: A Defining Moment

- Activism in the Financial World

- Jim Chanos Net Worth

- Investing Strategy and Philosophy

- Challenges and Criticisms

- The Future of Short-Selling

- Conclusion

Biography of Jim Chanos

Who is Jim Chanos?

Jim Chanos is a legendary short-seller and activist investor known for his keen insights into corporate malfeasance and market inefficiencies. Born in Milwaukee, Wisconsin, he has spent decades navigating the complexities of the financial markets, earning accolades for his ability to identify overvalued companies.

Chanos's career is marked by several high-profile short-selling campaigns, including his involvement in exposing Enron's fraudulent practices. His work in this area has not only contributed to his financial success but has also cemented his place as a thought leader in the financial world.

Early Life and Education

Jim Chanos's early life laid the foundation for his future success. Growing up in a family that valued education and intellectual curiosity, he developed a strong interest in economics and finance from a young age. Chanos pursued his higher education at Yale University, where he earned a degree in political science.

His educational background provided him with a solid understanding of global economic systems and the political factors influencing financial markets. This knowledge would later prove invaluable in his career as a short-seller.

Career Highlights

Chanos's career in finance began in the early 1980s, where he quickly established himself as a formidable force in the investment world. He founded Kynikos Associates, a hedge fund specializing in short-selling strategies, which has since become one of the most successful firms in its niche.

Throughout his career, Chanos has been involved in numerous high-profile short-selling campaigns, earning him recognition as one of the most successful short-sellers in history. His ability to identify and exploit market inefficiencies has consistently delivered impressive returns for his clients.

Read also:Understanding Maal49 A Comprehensive Guide To Its Origins Applications And Importance

The Art of Short-Selling

What is Short-Selling?

Short-selling is an investment strategy where investors bet on the decline in the value of a stock or asset. By borrowing shares and selling them at the current market price, short-sellers aim to repurchase the shares at a lower price, thereby profiting from the difference.

Jim Chanos's expertise in short-selling has been instrumental in his success. He meticulously researches companies, analyzing their financial statements and market positioning to identify potential weaknesses. This approach has allowed him to uncover fraudulent activities and overvalued stocks, contributing significantly to his net worth.

Chanos and Enron: A Defining Moment

One of the most defining moments in Jim Chanos's career was his involvement in exposing the fraudulent activities at Enron. Through diligent research and analysis, Chanos identified discrepancies in Enron's financial reports, raising red flags about the company's true financial health.

His efforts played a crucial role in bringing Enron's fraudulent practices to light, leading to one of the most significant corporate scandals in history. This experience not only solidified Chanos's reputation as a short-seller but also demonstrated the importance of rigorous financial analysis in uncovering corporate malfeasance.

Activism in the Financial World

Beyond his role as a short-seller, Jim Chanos is also known for his activism in the financial world. He frequently speaks out on issues related to corporate governance and market transparency, advocating for reforms that protect investors and promote ethical business practices.

Chanos's activism extends to his involvement in various financial forums and conferences, where he shares his insights and experiences with fellow investors. His contributions to the financial community have been invaluable in shaping the discourse around short-selling and its role in maintaining market integrity.

Jim Chanos Net Worth

As of 2023, Jim Chanos's net worth is estimated to be in the hundreds of millions of dollars. This figure is a testament to his success as a short-seller and activist investor, reflecting the significant returns generated by his investment strategies.

Factors contributing to Chanos's net worth include the performance of Kynikos Associates, his speaking engagements, and his involvement in various financial ventures. His ability to consistently deliver impressive returns has earned him a loyal following of investors and admirers.

Investing Strategy and Philosophy

Key Components of Chanos's Strategy

- Thorough Research: Chanos places a strong emphasis on conducting comprehensive research before making any investment decisions.

- Identifying Weaknesses: He focuses on identifying companies with underlying weaknesses, such as poor financial health or unethical practices.

- Long-Term Perspective: While short-selling is often associated with short-term gains, Chanos adopts a long-term perspective, allowing him to capitalize on market inefficiencies over time.

Chanos's philosophy centers around the importance of skepticism and critical thinking in the financial markets. He encourages investors to question conventional wisdom and seek out opportunities that others may overlook.

Challenges and Criticisms

Despite his success, Jim Chanos has faced challenges and criticisms throughout his career. Critics argue that short-selling can contribute to market instability and unfairly target companies. However, Chanos maintains that short-selling plays a vital role in maintaining market efficiency and exposing fraudulent practices.

He has also faced legal challenges in some of his short-selling campaigns, although these have generally been resolved in his favor. Chanos's resilience in the face of adversity underscores his commitment to his investment philosophy and principles.

The Future of Short-Selling

Looking ahead, the future of short-selling remains promising, with advancements in technology and data analysis providing new opportunities for investors like Jim Chanos. As markets continue to evolve, the role of short-sellers in maintaining market integrity will become increasingly important.

Chanos's insights into the future of short-selling highlight the need for continued innovation and adaptation in the financial industry. His contributions to the field will undoubtedly shape the strategies of future generations of investors.

Conclusion

In conclusion, Jim Chanos's journey in the financial world has been nothing short of remarkable. From his early days as a short-seller to his current status as a thought leader in the industry, Chanos has consistently demonstrated his expertise and commitment to ethical investing.

His net worth, estimated to be in the hundreds of millions, reflects the success of his investment strategies and his ability to navigate the complexities of the financial markets. As we look to the future, Chanos's insights and experiences will undoubtedly continue to influence the world of finance.

We invite you to share your thoughts and experiences in the comments below. For more insights into the world of finance, explore our other articles and resources. Together, let's continue to explore the fascinating world of investing and short-selling.