Retirement planning is a critical aspect of financial well-being, and Everfi offers tools to help individuals prepare for their future. If someone is retiring next year, Everfi provides a wealth of resources to ensure a smooth transition. Understanding how to leverage these tools and strategies can make all the difference in achieving financial independence.

Retirement is a milestone that requires careful planning and preparation. Whether you're nearing retirement or helping someone else who is retiring next year, Everfi has become a trusted platform for guiding individuals through this life-changing event. This article will explore the resources, strategies, and tools available through Everfi to help individuals plan effectively for their retirement.

By the end of this guide, you'll have a clear understanding of how Everfi can assist those preparing for retirement, along with actionable tips to ensure a secure financial future. Let's dive into the details to explore what Everfi offers and how it can benefit those retiring next year.

Read also:Melissa Womer A Comprehensive Look At Her Career Achievements And Impact

Understanding Everfi and Its Role in Retirement Planning

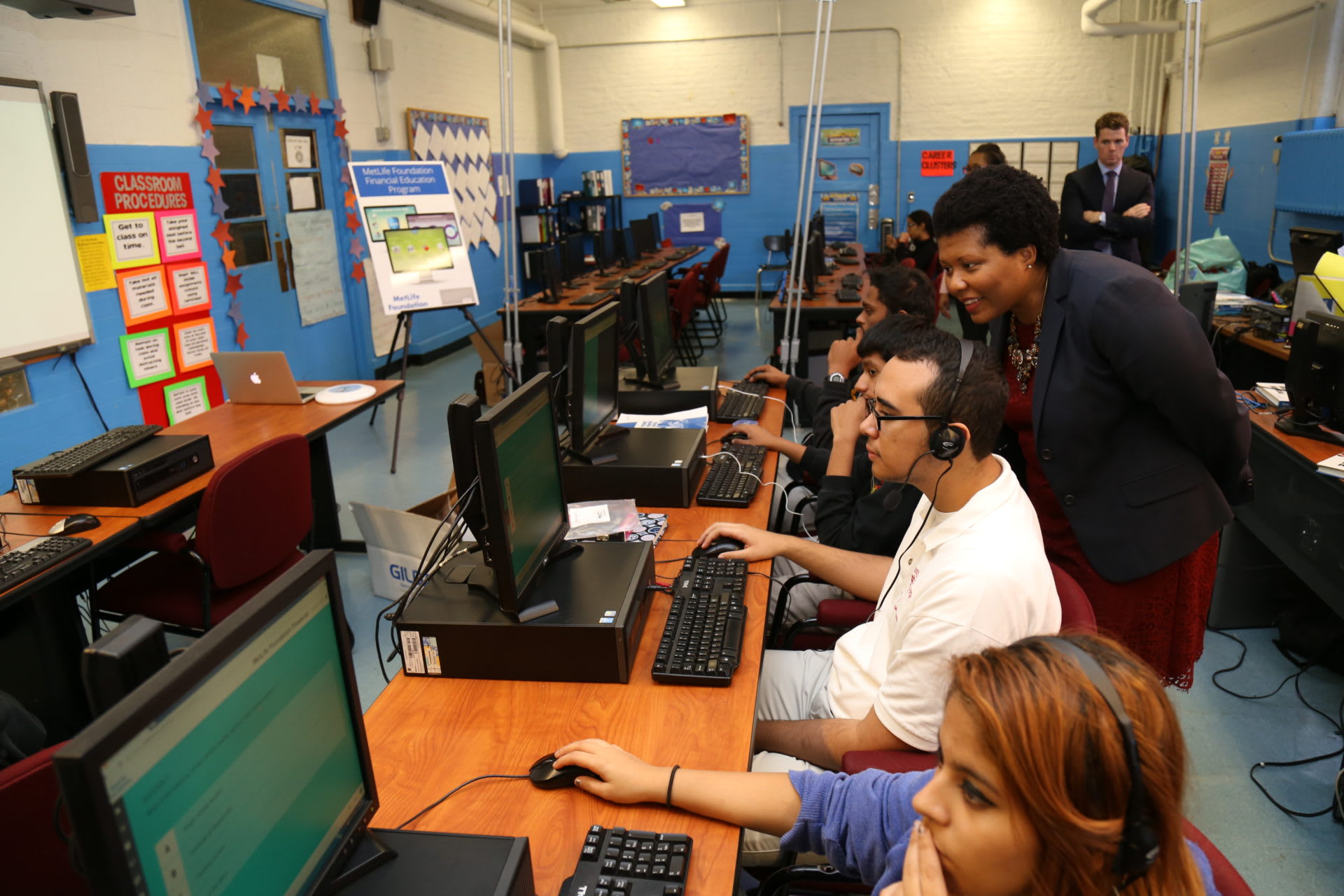

Everfi is a financial education platform designed to empower individuals with the knowledge and tools they need to make informed financial decisions. For someone retiring next year, Everfi provides a range of resources tailored to address the specific needs of retirees. These resources include interactive modules, educational content, and personalized advice to guide individuals through the complexities of retirement planning.

Everfi's approach focuses on financial literacy, ensuring that users understand the nuances of saving, investing, and managing their finances during retirement. By leveraging Everfi's tools, individuals can create a comprehensive retirement plan that aligns with their goals and lifestyle preferences.

Key Features of Everfi for Retirement Planning

- Interactive modules to educate users about retirement planning

- Personalized financial advice based on individual needs

- Access to expert resources and articles on retirement strategies

- Tools to calculate retirement savings and project future expenses

Biography of Everfi: A Leader in Financial Education

Everfi was founded with the mission of improving financial literacy across the globe. Since its inception, the platform has grown into a leading provider of financial education resources, helping millions of individuals prepare for their financial futures. Everfi's commitment to innovation and education has made it a trusted name in the financial industry.

Data and Biodata of Everfi

| Founder | Ray Martinez and Tom Davidson |

|---|---|

| Year Founded | 2008 |

| Headquarters | Washington, D.C. |

| Mission | To empower individuals with the knowledge and tools needed for financial success |

Retirement Planning with Everfi: Why It Matters

Retirement planning is not just about saving money; it's about creating a sustainable financial plan that supports your lifestyle and goals. For someone retiring next year, Everfi offers a holistic approach to retirement planning, addressing everything from budgeting and investing to healthcare and estate planning.

Research shows that individuals who engage in comprehensive retirement planning tend to experience greater financial security and peace of mind. According to a study by the Employee Benefit Research Institute (EBRI), individuals who use financial planning tools are more likely to achieve their retirement goals.

Steps to Prepare for Retirement with Everfi

Preparing for retirement involves several key steps, and Everfi provides resources to guide individuals through each stage. Below is a breakdown of the essential steps to consider:

Read also:Kate Garraway Partner A Deep Dive Into The Life And Career Of Derek Draper

1. Assess Your Current Financial Situation

Before creating a retirement plan, it's crucial to evaluate your current financial standing. This includes reviewing your income, savings, and any outstanding debts. Everfi's financial assessment tools can help you gain clarity on your financial health.

2. Set Clear Retirement Goals

Defining your retirement goals is the next step in the planning process. Consider factors such as your desired retirement age, lifestyle preferences, and estimated expenses. Everfi offers goal-setting tools to help you create a roadmap for your retirement.

3. Create a Retirement Budget

A well-planned budget is essential for ensuring financial stability during retirement. Everfi's budgeting tools allow you to project your expenses and adjust your savings accordingly.

4. Explore Investment Options

Investing wisely is crucial for growing your retirement savings. Everfi provides educational resources on various investment options, helping you make informed decisions about where to allocate your funds.

5. Plan for Healthcare Costs

Healthcare expenses can be a significant concern for retirees. Everfi offers guidance on Medicare, supplemental insurance, and other healthcare-related costs to ensure you're prepared for the future.

Benefits of Using Everfi for Retirement Planning

Using Everfi for retirement planning offers numerous advantages, including:

- Access to expert financial advice

- Interactive and engaging learning modules

- Personalized retirement planning tools

- Comprehensive resources on a wide range of financial topics

Everfi's user-friendly platform makes it easy for individuals to navigate the complexities of retirement planning, ensuring they have the information they need to make informed decisions.

Challenges in Retirement Planning and How Everfi Can Help

Retirement planning comes with its own set of challenges, such as market volatility, inflation, and unexpected expenses. Everfi addresses these challenges by providing resources and tools to help individuals mitigate risks and prepare for the unexpected.

For instance, Everfi's retirement calculators allow users to project their savings growth and adjust their plans accordingly. Additionally, the platform offers educational content on managing inflation and diversifying investments to protect against market fluctuations.

Case Studies: Success Stories with Everfi

Real-world examples of individuals who have successfully used Everfi for retirement planning can provide valuable insights. Below are two case studies that highlight the effectiveness of Everfi's resources:

Case Study 1: John's Journey to Financial Independence

John, a 65-year-old retiree, used Everfi's retirement planning tools to create a comprehensive financial plan. By leveraging the platform's budgeting and investment resources, John was able to achieve financial independence and enjoy a comfortable retirement.

Case Study 2: Sarah's Strategic Approach to Retirement

Sarah, a 58-year-old pre-retiree, utilized Everfi's educational modules to gain a deeper understanding of retirement planning. With the help of Everfi's personalized advice, Sarah developed a strategic plan to maximize her savings and minimize her tax liabilities during retirement.

Tips for Someone Retiring Next Year

If you're retiring next year, here are some actionable tips to ensure a smooth transition:

- Review your retirement accounts and adjust your contributions if necessary

- Meet with a financial advisor to discuss your retirement plan

- Update your will and estate planning documents

- Explore part-time work or other income-generating opportunities

- Stay informed about changes in retirement laws and regulations

By following these tips and utilizing Everfi's resources, you can set yourself up for a successful retirement.

Conclusion: Securing Your Financial Future with Everfi

In conclusion, someone retiring next year can benefit significantly from Everfi's comprehensive retirement planning resources. By understanding the platform's features, following the outlined steps, and staying informed about retirement planning strategies, individuals can achieve financial security and peace of mind during their retirement years.

We encourage you to explore Everfi's tools and resources to begin your retirement planning journey. Don't forget to share this article with others who may find it helpful and leave a comment below with your thoughts or questions. Together, we can create a more financially literate and secure future for everyone.

Table of Contents

- Understanding Everfi and Its Role in Retirement Planning

- Biography of Everfi: A Leader in Financial Education

- Retirement Planning with Everfi: Why It Matters

- Steps to Prepare for Retirement with Everfi

- Benefits of Using Everfi for Retirement Planning

- Challenges in Retirement Planning and How Everfi Can Help

- Case Studies: Success Stories with Everfi

- Tips for Someone Retiring Next Year

- Conclusion: Securing Your Financial Future with Everfi