Accessing your W2 form from Bank of America is an essential step for former employees who need accurate tax documentation. Whether you’re filing taxes or updating financial records, understanding how to retrieve your W2 can save you time and frustration. This article will guide you step by step through the process of obtaining your W2 as a former Bank of America employee.

In today's digital world, managing financial documents has become easier with online tools and resources. However, for former employees, navigating through these systems can sometimes feel overwhelming. That’s why it’s important to know exactly what steps to take when you need a W2 from Bank of America.

By the end of this guide, you’ll have all the information you need to request and receive your W2 efficiently. Let’s dive into the details so you can take control of your financial records.

Read also:Olivia Attwood Boyfriend A Comprehensive Guide To Love Life And Relationships

Table of Contents

- Biography of Bank of America

- Overview of W2 Forms

- How to Request Your W2 as a Former Employee

- Accessing W2 Forms Online

- Requesting W2 Through Mail

- Timeline for W2 Delivery

- Troubleshooting Common W2 Issues

- Tax Implications of W2 Forms

- Resources for Former Employees

- Conclusion and Next Steps

Biography of Bank of America

Bank of America is one of the largest financial institutions in the United States, with a rich history dating back to 1904. Below is a brief overview of its background:

| Company Name | Bank of America |

|---|---|

| Founded | 1904 |

| Headquarters | Charlotte, North Carolina |

| Industry | Banking and Financial Services |

| Revenue | $110.5 billion (2022) |

| Employees | 208,000+ |

Bank of America has a long-standing reputation for providing comprehensive financial services, including employment benefits like W2 forms for its employees.

Overview of W2 Forms

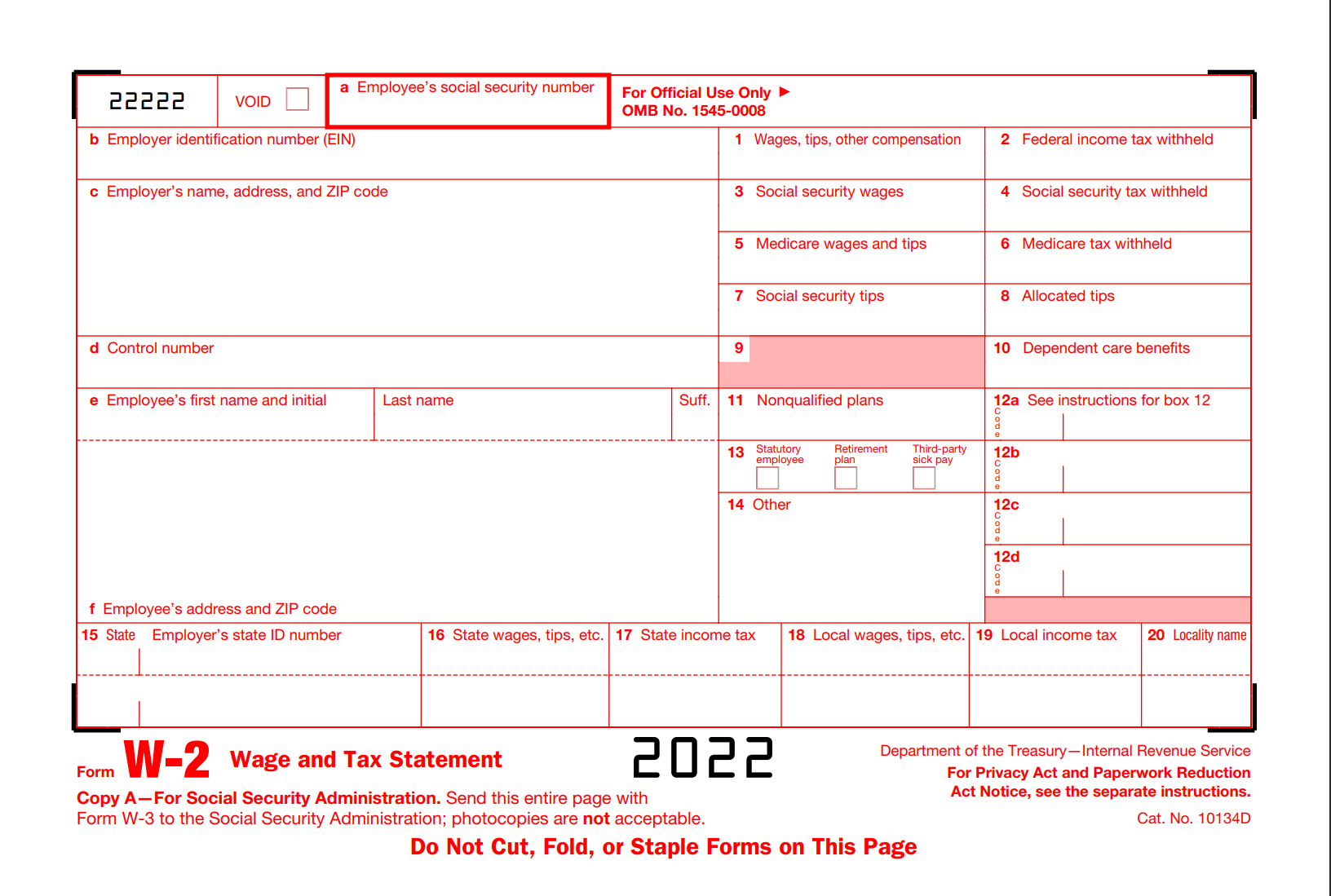

A W2 form is a crucial document issued by employers to employees at the end of each tax year. It details the wages earned and taxes withheld during the year. For former Bank of America employees, obtaining this form is essential for accurate tax reporting.

Why W2 Forms Are Important

- Used to file federal and state income taxes

- Provides proof of income for loans or financial applications

- Helps ensure accurate tax refunds or payments

How to Request Your W2 as a Former Employee

Requesting your W2 from Bank of America as a former employee involves a few straightforward steps. Below, we outline the process:

Contacting Bank of America HR

Reach out to Bank of America's Human Resources department for assistance. They can guide you on how to obtain your W2 based on your employment history.

Accessing W2 Forms Online

In the digital age, many companies offer online access to important documents like W2 forms. Bank of America provides an online portal where former employees can log in and retrieve their W2s.

Read also:Gil Dezer Net Worth Exploring The Wealth Of A Visionary Entrepreneur

Steps to Access W2 Online

- Visit the Bank of America employee portal

- Log in using your credentials

- Navigate to the "Tax Documents" section

- Download or print your W2 form

Requesting W2 Through Mail

If online access is not an option, you can request your W2 form by mail. Follow these steps to ensure a smooth process:

Preparing Your Request

- Write a formal letter stating your request

- Include your full name, Social Security number, and contact information

- Specify the tax year(s) for which you need the W2

Timeline for W2 Delivery

Understanding the timeline for W2 delivery is important to avoid delays in filing taxes. Typically, employers are required to send out W2 forms by January 31st following the end of the tax year.

Delays in W2 Delivery

If your W2 hasn’t arrived by mid-February, consider contacting Bank of America’s HR department for assistance. Delays can occur due to various reasons, such as processing times or address changes.

Troubleshooting Common W2 Issues

Encountering issues with your W2 form is not uncommon. Below are some common problems and solutions:

Incorrect Information on W2

- Contact Bank of America HR immediately to report errors

- Provide supporting documents to verify corrections

Tax Implications of W2 Forms

Your W2 form plays a critical role in determining your tax obligations. It reflects your annual income and deductions, influencing how much tax you owe or how much refund you may receive.

Impact on Tax Refunds

Having an accurate W2 ensures that you receive the correct tax refund. Any discrepancies could lead to delays or incorrect refund amounts.

Resources for Former Employees

Bank of America offers various resources to assist former employees with their W2 requests. Below are some useful links:

Conclusion and Next Steps

Obtaining a W2 form from Bank of America as a former employee doesn’t have to be a daunting task. By following the steps outlined in this guide, you can efficiently retrieve your W2 and ensure accurate tax filings.

We encourage you to take action by either accessing your W2 online or contacting Bank of America’s HR department. Additionally, feel free to share this guide with others who may find it helpful. Your feedback and questions are always welcome in the comments section below.

Stay informed and proactive about your financial records. For more articles on tax and financial management, explore our website further.